What Is Yield Curve In Bond Market Chart?

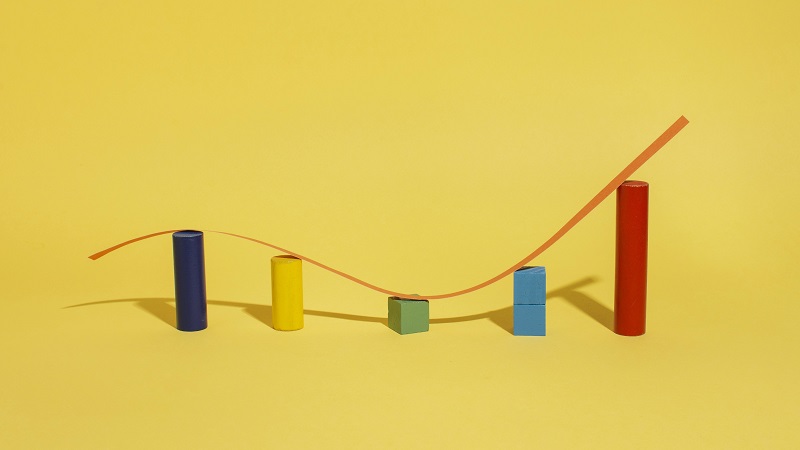

The yield curve may appear to be something you learned and then forgot about, but it is a vital aspect of understanding the bond market chart, borrowing costs, and the larger economy, and it may even predict when the next recession will occur.

The yield curve measures interest rates over time, from one month to 30 years, and provides lenders and borrowers with an indication of how much money will cost them over time. Furthermore, the yield curve in the bond ratings chart influences everything from the interest rate on a certificate of deposit to the cost of obtaining a vehicle loan, mortgage, or business loan.

The yield curve may even impact the stock market, as when longer-term yields begin to fall in comparison to shorter-term yields, investors begin to worry about a probable slowdown in the economy.

When the long-term yield inverts or goes below the short-term yield, it has historically been a precursor of recession, and all of these are strong reasons to keep a close check on the yield curve.

Overview of Yield Curve in Bond Market Chart

The benchmark yield curve is made up of U.S. treasury index, and it plots yields on short-term treasury bills, medium-term treasury notes, and long-term government bonds. All other fixed-income instruments base their rates on the US treasury yield curve.

The fed funds rate, or the interest rate at which banks trade federal funds, such as balances maintained at federal reserve banks, with each other overnight, influences Treasury rates. The bond market chart then decides that rate, although it is impacted by the fed funds target rate, which is set by the Federal Reserve’s Federal Open Market Committee eight times a year.

So, when you hear that the Fed has hiked rates to, say, 3% to 3.25%, that means it is the fed funds target rate, which influences short-term interest rates at the left end of the yield curve. Furthermore, because the rest of the yield curve frequently mimics the Fed funds target rate, longer-term rates tend to climb when the Fed boosts short-term rates.

Yields respond to other circumstances, since they frequently rise during inflationary periods when bond investors demand greater compensation for the degrading effect of inflation on the value of their money. Further, supply and demand have a role, as rates frequently fall when the Treasury Department issues a large number of new bonds.

The Front and Back View of Yield Curve on Bond Market Chart

Because the yield curve in the bond market chart depicts the cost of money from one month to 30 years in the future, those time periods are divided into sections called as the front end, belly, and back end.

Furthermore, different rates over time are useful for determining the yield you can expect from investments or the interest rate you will pay on loans. If you’re taking out a loan for a car or a house, it’s important to look at rates that extend much further than one month because your loan will be lengthy, but if you’re opening a one-year CD, the rate you receive will be determined by the yield curve and is typically much lower than the rate you’ll pay.

- Front end – The term “front end” refers to short-term securities that will expire in the near future, usually within a year or less, and are the most sensitive to interest rate swings. Banks establish deposit levels for checking accounts and savings deposits using short-end rates, and a high-interest rate on a deposit account is one way for banks to persuade you to open an account.

- Belly – The belly of the curve is the midsection of the curve, reflecting rates from two years out to a decade, while longer-term CDs, such as three and five-year CDs, are based on rates in the shorter end.

- Back end – Back-end interest rates are used for longer-term bonds with maturities of 10 years or more, as well as mortgages and long-term corporate bonds.

Reading Yield Curve in Bond Market Charts

The yield curve goes in two directions: up and down. A normal yield curve slopes upward, indicating that the interest rate on shorter-dated bonds is lower than the rate on longer-dated bonds. And this pays long-term bondholders for the time worth of money as well as any potential danger that the bond issuer may default.

A curve with higher back end rates, on the other hand, is frequently referred to as a steepening yield curve because yields rise over time and, when plotted on a chart, the line goes from the lower left to the upper right, indicating a higher progression of interest rates.

Flat or Inverted Yield Curve

When the yield curve flattens, resembling a pancake rather than a rising ski slope, bond market investors become concerned because the form of the curve will invert, with longer-term rates falling below short-term yields.

A flat curve can occur when short-term rates rise or long-term rates fall, and it can signify a recession since rising short-term rates indicate fears of job loss or business closure, making debt more difficult to repay and short-term loans riskier.

In this case, investors seek higher compensation in exchange for increased short-term risk, because short-term yields can rise relative to longer-term yields if the Fed is in a rate hike cycle, which attempts to slow the economy by making money more difficult to borrow. Furthermore, rate increases have the greatest impact on the front end of the yield curve, forcing rates to climb faster than longer-term rates.

On the other side, constant or falling long-term rates occur when the economy slows and investors seek alternative investments because they do not foresee a strong return in the stock market. This causes them to gravitate toward the higher yields offered by long-term bonds, and the increased demand causes back-end bond prices to rise, resulting in lower yields.

Takeaway

The yield curve is a simple graphic that provides a wealth of helpful information. For example, if you want to invest in a bond or CD, the yield curve can advise you where to get the most bang for your dollars. The same is true if you’re wanting to borrow, such as with a mortgage or auto loan, and as an investor, the shape of the curve can help suggest which direction the economic winds are blowing and whether a recession is imminent.

FAQs

1. What is a yield curve in the bond market?

The yield curve is a graphical representation of the yields or interest rates of various maturities of bonds. It depicts the link between interest rates (yields) and maturity dates of bonds issued by the same issuer and with comparable credit ratings.

2. How is the yield curve constructed and interpreted?

The yield curve is created by plotting the yields of various maturities of bonds on the vertical axis and the matching time to maturity on the horizontal axis. The resulting curve usually has one of three shapes: normal (upward sloping), flat, or inverted (downward sloping).

3. What are the key factors influencing the shape of the yield curve?

The yield curve’s shape is impacted by a number of factors, including current monetary policy, inflation forecasts, and market mood. An upward-sloping yield curve generally indicates that investors anticipate higher interest rates in the future due to anticipated economic expansion, whereas a flat or inverted curve may indicate fears about an economic slowdown or impending recession.

4. What is the significance of an inverted yield curve?

When short-term interest rates are greater than long-term interest rates, the yield curve inverts. It is frequently seen as a strong predictor of an oncoming economic downturn.

5. How can I use the yield curve to inform my investment decisions?

The yield curve can be used by investors to gauge the overall health of the economy and make smart investment decisions. A rising yield curve, for example, may signal a favorable economic environment for taking on greater risk and investing in longer-term bonds or equities.